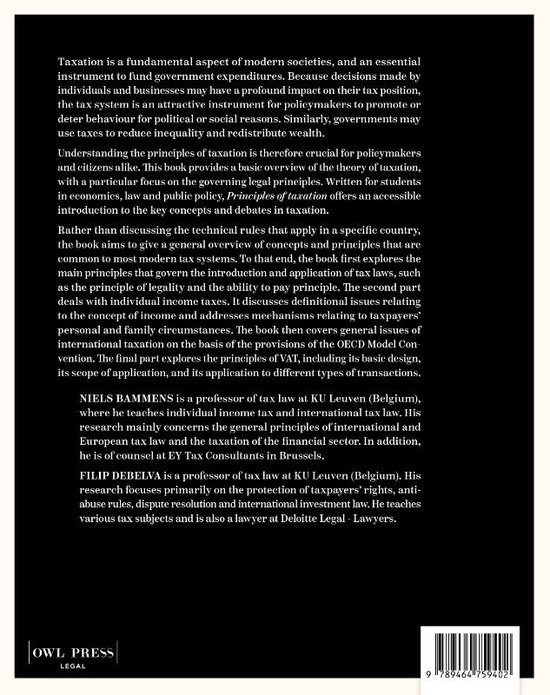

Principles of Taxation

Afbeeldingen

Sla de afbeeldingen overArtikel vergelijken

Auteur:

Filip Debelva

Niels Bammens

- Engels

- Paperback

- 9789464759747

- 15 december 2023

- 300 pagina's

Samenvatting

Taxation is a fundamental aspect of modern societies, and an essential instrument to fund government expenditures. Without taxes, governments would be unable to provide public services relating to healthcare, education, infrastructure or social welfare. Because of their importance, taxes permeate every aspect of society. Businesses are faced with tax consequences when selling goods or providing services, when paying salaries, when expanding into a new market, etc. But the decisions of individuals may also have a profound impact on their tax position, for instance if they are entitled to tax benefits on the basis of their marital status, or if their tax burden increases because they drive a high-emission vehicle. Given that impact, tax considerations may affect individuals’ decisions, which makes taxation an attractive instrument for policymakers to promote or deter behavior for political or social reasons. Similarly, governments may use taxes to reduce inequality and redistribute wealth.

Understanding the principles of taxation is therefore crucial for policymakers and citizens alike. This book provides a basic overview of the theory of taxation, with a particular focus on the governing legal principles. Written for students in economics, law and public policy, Principles of taxation offers an accessible introduction to the key concepts and debates in taxation.

Rather than discussing the technical rules that apply in a specific country, the book aims to give a general overview of concepts and principles that are common to most modern tax systems. The book first explores the main principles that govern the introduction and application of tax laws. The second part deals with individual income taxes. The book then covers general issues of international taxation on the basis of the provisions of the OECD Model Convention. The final part explores the principles of VAT.

Understanding the principles of taxation is therefore crucial for policymakers and citizens alike. This book provides a basic overview of the theory of taxation, with a particular focus on the governing legal principles. Written for students in economics, law and public policy, Principles of taxation offers an accessible introduction to the key concepts and debates in taxation.

Rather than discussing the technical rules that apply in a specific country, the book aims to give a general overview of concepts and principles that are common to most modern tax systems. The book first explores the main principles that govern the introduction and application of tax laws. The second part deals with individual income taxes. The book then covers general issues of international taxation on the basis of the provisions of the OECD Model Convention. The final part explores the principles of VAT.

Productspecificaties

Wij vonden geen specificaties voor jouw zoekopdracht '{SEARCH}'.

Inhoud

- Taal

- en

- Bindwijze

- Paperback

- Oorspronkelijke releasedatum

- 15 december 2023

- Aantal pagina's

- 300

- Illustraties

- Nee

Betrokkenen

- Hoofdauteur

- Filip Debelva

- Tweede Auteur

- Niels Bammens

- Hoofduitgeverij

- Owl Press

Overige kenmerken

- Editie

- 1

- Product breedte

- 192 mm

- Product hoogte

- 25 mm

- Product lengte

- 242 mm

- Studieboek

- Ja

- Verpakking breedte

- 192 mm

- Verpakking hoogte

- 25 mm

- Verpakking lengte

- 242 mm

- Verpakkingsgewicht

- 771 g

EAN

- EAN

- 9789464759747

Je vindt dit artikel in

- Categorieën

- Taal

- Engels

- Boek, ebook of luisterboek?

- Boek

- Studieboek of algemeen

- Algemene boeken

- Select-bezorgopties

- Vandaag Bezorgd, Avondbezorging, Zondagbezorging, Gratis verzending

Kies gewenste uitvoering

Kies je variant

(2)

Prijsinformatie en bestellen

De prijs van dit product is 78 euro en 99 cent.

Verkoop door bol

- Prijs inclusief verzendkosten, verstuurd door bol

- Ophalen bij een bol afhaalpunt mogelijk

- 30 dagen bedenktijd en gratis retourneren

- Dag en nacht klantenservice

Shop dit artikel

Rapporteer dit artikel

Je wilt melding doen van illegale inhoud over dit artikel:

- Ik wil melding doen als klant

- Ik wil melding doen als autoriteit of trusted flagger

- Ik wil melding doen als partner

- Ik wil melding doen als merkhouder

Geen klant, autoriteit, trusted flagger, merkhouder of partner? Gebruik dan onderstaande link om melding te doen.